Retail Media Network Fragmentation Costs

Managing retail media campaigns across 60+ networks costs brands nearly 20% in lost revenue from fragmentation alone, according to Forrester Research. With 200+ active retail media networks globally, brands are typically managing just 6 platforms simultaneously—projected to double to 11 in 2026—this is an operational burden that has become the single biggest barrier to retail media growth. This creates a cascading series of costs:

- 15-20 hours weekly spent on manual reporting consolidation,

- 33% of retail media spend delivering incremental ROI below 1x (representing over $10 billion in optimization opportunities),

- attribution window differences creating 50-80% ROAS variance on identical campaigns measured across different networks.

For a US marketing manager allocating multi-million dollar budgets across Amazon, Walmart, Target, Instacart, Kroger, and CVS, these inefficiencies compound rapidly—but solutions exist. Unified management platforms can reduce operational time by 40-60% while improving ROAS by 34-200%, and brands adopting sophisticated frameworks with centralized measurement are capturing market share from competitors still managing platforms individually.

Platform management consumes 160+ hours monthly without automation

The operational reality of managing multiple retail media networks involves substantial time investments that scale linearly without automation. Research from 2024-2025 reveals operations teams spend 20-40% of their weekly time on manual data wrangling—approximately 8-16 hours per week just consolidating data into unified views. Manual reporting consolidation alone consumes 15-20 hours weekly when pulling data from Amazon Ads, Walmart Connect, Target Roundel, CVS, Instacart, Kroger and other major platforms. Each network requires separate workflows: 70% of RMN buyers cite complexity in the buying process as the biggest obstacle to growth, while 62% identify lack of measurement standards as a major challenge.

Campaign setup complexity varies dramatically by platform maturity. Georgia-Pacific’s case study illustrates the scale: the company evaluated approximately 40 retail media networks and conducted trials with more than 25 networks before settling on their current mix, where they now spend over 20% of their media budget. This evaluation process alone represents hundreds of hours of personnel time. Once campaigns launch, manual bid management requires daily updates across platforms without automation—a burden that has become unsustainable as CPC volatility surged in Q3 2024, with Target increasing 12.9% quarter-over-quarter and Instacart up 4.9%.

Product catalog uploads present another significant time sink. Walmart’s bulk upload processing takes 15 minutes to 4 hours depending on catalog size, with large catalogs requiring up to 72 hours to fully process bulk files containing the maximum 10,000 items per upload. Migrating catalogs between platforms—such as moving thousands of SKUs from Amazon to Walmart—typically requires 48 hours for professional migration services. Each retail media network maintains different technical specifications for feeds, formats, and requirements, forcing brands to customize uploads for each platform rather than using standardized processes.

Budget reallocation and optimization require cross-functional coordination that delays critical decisions. One beauty brand’s incrementality testing revealed they should shift 30% of Sephora’s budget to Amazon based on performance data, resulting in 22% more incremental sales overall. But implementing such changes manually requires coordination meetings, approvals, and platform-by-platform execution. Automated systems can rebalance budgets mid-flight across networks in real-time, while manual processes stretch across days or weeks. The fashion advertiser case study on Walmart Connect showed that even a focused 21-day dynamic bidding optimization test delivered significant results (+20% ad-attributed sales, +12% orders, +5% conversion), but required dedicated attention that most teams cannot sustain across multiple platforms simultaneously.

The cumulative time investment creates an impossible scaling challenge. Managing campaigns across 5 networks without automation requires an estimated 30-50 hours monthly per network for setup, weekly optimization (5-10 hours), monthly reporting (4-8 hours), and strategic reviews (2-4 hours). This totals 150-250 hours monthly or approximately 1-1.5 FTE just for execution across five platforms—before accounting for strategy, stakeholder management, or growth initiatives.

Staffing requirements range from 2-10 FTEs depending on scale and automation

Industry benchmarks for retail media team staffing reveal significant variance based on advertising spend and automation sophistication.

- For brands spending $500K-$2M annually, staffing requirements typically range from 1-2 FTEs (one manager plus one specialist or two campaign managers) managing 2-5 platforms.

- At $2M-$5M annual spend, teams expand to 2-4 FTEs (one manager plus 2-3 specialists/analysts) across 5-8 platforms.

- For $5M-$10M budgets, brands typically employ 4-6 FTEs (one director, 1-2 managers, 3-4 specialists) managing 8-12 platforms.

- Enterprise brands spending $10M+ annually require 6-10+ FTEs organized as full departments with specialized roles across 12+ retail media networks.

This gives a general rule of thumb for manual retail media network management: 1 FTE per $1M-$2M in ad spend or 1 FTE per 2-3 major RMNs being actively managed. With automation platforms like RMIQ, Pacvue, Skai, or CommerceIQ, this improves to 1 FTE per $2M-$5M in spend or 1 FTE per 4-6 RMNs, representing 40-60% efficiency gains.

Salary ranges for retail media roles in the 2024-2025 US market show Retail Media Managers averaging $74,658 annually ($36/hour), with typical ranges from $57,837 (25th percentile) to $97,644 (75th percentile) and top earners at $123,272. Retail Marketing Managers command higher compensation at $104,815 average ($50/hour), ranging from $81,253 to $136,974. Retail Analysts average $72,385 ($35/hour), while Senior Retail Analysts earn $129,431 ($62/hour). Media Specialists and Analysts typically earn $55,734-$63,956 ($27-36/hour).

Fully loaded costs—including benefits, taxes, and overhead—add 30-50% to base salaries, resulting in true hourly costs of $47-87 across various retail media roles. For a typical 3-person retail media team, total annual costs range from $302,000-$485,000 including salaries, benefits, overhead, training, and tech stack. A 5-person team costs $505,000-$710,000 annually. These figures make the in-house vs. agency decision critical: agencies typically charge 15-20% management fees or $2,500-$10,000 monthly retainers, which can represent 50-75% cost savings compared to building full in-house teams, though 82% of ANA members now maintain some in-house capabilities (up from 58% in 2013).

The challenge intensifies with retail media’s unique talent requirements. Industry experts describe retail media professionals as “unicorns” requiring strategic thinking, platform expertise, data proficiency, retail knowledge, and technical skills—a combination that creates talent scarcity and drives higher compensation. Training costs add $954 per learner annually for general corporate training, with additional platform-specific training required for each new RMN. With 60%+ annual turnover in retail roles and $3,328 replacement costs for employees earning $10/hour, continuous retraining becomes a hidden expense. Some organizations employ teams of 10+ professionals solely focused on statement reconciliation between vendor bills, finance, and analytics—a wholly avoidable expense with proper automation.

Attribution windows create 50-80% ROAS variance on identical campaigns

One of retail media’s most insidious hidden costs stems from measurement inconsistencies that make cross-network comparison nearly impossible. The attribution windows cited in your query require corrections based on 2024-2025 documentation: Amazon uses 7-day attribution for Seller Central and 14-day for Vendor Central (not uniformly 14-day), Walmart Connect defaults to 14-day attribution with 3-day and 30-day options available (not 7-day), and Instacart uses 14-day click attribution with multi-touch models as default since August 2022 (not 1-day). These differences alone create measurement chaos, but the problem extends far deeper.

A hypothetical but research-grounded scenario illustrates the impact: a beauty brand running the same $10,000 campaign across multiple networks could see reported results ranging from $32,000 to $58,000 in attributed revenue—an 81% variance—depending solely on which platform’s measurement methodology is used. Amazon Seller accounts with 7-day windows might report 3.2x ROAS, while the identical campaign measured with Amazon Vendor’s 14-day window shows 4.1x ROAS. Walmart using their 30-day attribution option could report 5.2x ROAS for the same campaign, while Target Roundel with 14-day click plus 14-day view attribution reports 5.8x ROAS. Instacart’s multi-touch attribution, which distributes credit across touchpoints rather than giving full credit to the last click, might show 3.9x ROAS. None of these differences reflect actual performance—they’re purely measurement artifacts.

The business impact cascades into budget allocation errors that waste millions annually. One documented example: a CPG company initially allocated 50% of budget ($500K) to Amazon Sponsored Products based on reported 5.2x ROAS, 30% ($300K) to Walmart showing 4.1x ROAS, and 20% ($200K) to Instacart showing 3.5x ROAS. After incrementality testing revealed true incremental impact, the optimal allocation reversed: Walmart deserved 45% ($450K) with 3.9x incremental ROAS, Instacart 35% ($350K) with 3.2x incremental ROAS, and Amazon just 20% ($200K) with only 1.8x incremental ROAS (high brand search meant customers would’ve purchased anyway). This reallocation captured $300K in annual value previously wasted on non-incremental spend.

Product category dramatically affects optimal attribution windows. High-frequency, low-ticket grocery items need 3-7 day windows because longer windows capture habitual repurchases rather than ad-driven incremental sales. Low-frequency, high-ticket items like appliances need 14-30+ day windows to capture research-intensive purchase cycles. Walmart’s testing across 3-day, 14-day, and 30-day windows found everyday grocery items showed minimal difference between windows, while high-consideration categories (car parts, home accessories) showed significantly higher in-store attribution with longer windows—meaning brands using standardized 14-day windows systematically under-measure performance for considered purchases and over-measure for impulse buys.

The last-touch attribution bias compounds these problems. Research shows 80% of major RMN ad types use last-touch attribution, completely ignoring upper-funnel contribution. This creates the “ROAS trap” where brands over-invest in bottom-funnel tactics showing inflated ROAS while under-funding awareness campaigns. Criteo research found retail media campaigns deliver value beyond measured ROAS: paid campaigns increase organic search visibility by 56% in North America within 2 weeks, shoppers exposed to ads buy other brand products not included in campaigns (halo effects), and shoppers who purchase after seeing ads buy from the brand 5 more times in the next 6 months. Attribution windows only measure direct click-to-purchase, missing 40-50% of total campaign value.

The industry recognizes this crisis: 62% of retail media buyers are dissatisfied with performance measurement (IAB/KPMG 2024), and 55% of marketers cite lack of standardization as their greatest challenge (ANA survey). Only 23% of retailers share campaign data in real-time, with some promising reporting two months after campaign close but advertisers waiting up to 5 months for final results. These delays prevent rapid budget reallocation, compounding losses from underperforming campaigns for weeks or months while $10 billion worth of investment delivers incremental ROI below 1x.

Hidden costs extend far beyond direct time investments

Beyond measurable hours and salaries, retail media fragmentation generates substantial hidden costs that most brands fail to quantify. Forrester research quantifies the overall impact: fragmentation leads to nearly 20% revenue loss across retail media networks—the top barrier to retail media success. With $140 billion in global retail media spending in 2024, this represents approximately $28 billion in lost revenue potential industry-wide.

Opportunity costs from networks ignored due to complexity represent significant missed revenue. KPMG research found that while the average brand worked with 6 RMNs in 2024 (projected to reach 11 by 2026), only 35% of brands added a new RMN in 2024, down from 58% in 2023. This consolidation reflects brands actively reducing complexity rather than capturing emerging opportunities. Smaller networks typically lack robust tools for targeting and measurement, making it harder for advertisers to execute and scale campaigns effectively—so these networks remain ignored despite potentially reaching valuable audiences. Georgia-Pacific evaluated around 40 retail media networks but only actively uses a portion, representing dozens of potential audience segments left untapped due to operational constraints.

Revenue loss from delayed optimizations compounds daily. With 33% of retail media spend delivering incremental ROI below 1x (brands getting less than $1 back per dollar invested), this equals over $10 billion worth of investment industry-wide that could be optimized. The Current Media research found that if poor-performing campaigns are identified quickly and budgets reallocated to stronger-performing campaigns, brands can generate significant additional sales with the same budget. But reporting delays prevent this: some RMNs promise reporting two months after campaign close but advertisers often wait up to 5 months, making it “difficult to learn and pivot quickly.” Only 23% of retailers share data in real-time, meaning 77% of advertisers cannot make timely optimizations.

The cost of inconsistent measurement extends beyond confusion to actual decision-quality degradation. 62% of retail media buyers are dissatisfied with performance measurement, leading to suboptimal budget allocation. Manual reconciliation requires 15+ step processes involving vendor bills, finance, media departments, and analytics—taking weeks from start to finish. Some organizations employ teams of 10+ professionals solely for statement reconciliation, described as a “wholly avoidable and expensive deployment of resource.” Brands waste valuable time analyzing and normalizing results across platforms with different naming conventions: Amazon reports “Total Sales,” Walmart reports “GMV,” grocery RMNs report “in-store vs. online sales” differently, and manual CSV exports invite errors that cascade through financial planning.

Training time for different platform interfaces creates recurring costs amplified by retail’s high turnover. General employee training costs average $954 per learner for 57 hours annually, but retail media platform training is additional and repetitive. With 60%+ annual turnover in retail roles and $3,328 replacement costs for entry-level employees, continuous retraining on platform interfaces becomes a hidden tax. Each new RMN requires separate training on different user interfaces, varying metrics and reporting standards, unique campaign management tools, and platform-specific optimization approaches. The retail sector spends $19 billion annually on recruiting, hiring, and training, with standard onboarding taking 8 weeks to fully integrate a new hire—during which they’re learning platform mechanics rather than driving results.

Technology costs for managing fragmented platforms create additional overhead. Brands typically require disparate tech stacks including DMPs/CDPs, DSPs, SSPs, ad servers, order management systems, and analytics platforms—with 58% of marketers relying on business intelligence tools specifically to manage retail media complexity. These subscriptions, integration costs, and maintenance overhead add $12,000-$50,000 annually to tech budgets. Meanwhile, some RMNs still send performance reports via email rather than through integrated systems, forcing manual data entry. The fragmented technology landscape creates “sizable missed revenue opportunities” from inability to scale efficiently, as disjointed tools complicate integration and prevent cohesive functional frameworks.

Budget waste from suboptimal allocation represents perhaps the largest hidden cost. Research shows companies with sophisticated retail media budgeting frameworks achieve 34% higher ROAS compared to traditional approaches—meaning most companies without sophisticated frameworks leave 34% improvement on the table. Nielsen found cross-media strategies yield 5X improvement in on-target reach (from 17% for single-channel to 90% for well-balanced campaigns), but too many advertisers remain set in their ways out of habit or fear. Budget silos between brand marketing, trade, and e-commerce teams delay decision-making and limit flexibility, preventing advertisers from fully capitalizing on retail media potential. Poor identity resolution leads to over-targeting the same shoppers with redundant messaging, increasing impressions and spend against the same individuals rather than reaching new, in-market audiences—pure waste.

The retail media landscape has exploded to 200+ networks

The retail media network ecosystem has experienced explosive growth, becoming the fourth-largest advertising channel globally with 200-216 active RMNs worldwide according to Mimbi’s database (updated June 2025), while Flipflow tracks 390 RMNs including smaller networks. In the US specifically, 80+ RMNs are currently operating, and among the top 100 US retailers, 80% have either launched or are building RMNs as of 2024. Deloitte polling in December 2023 found 64% of retailers planned to implement an RMN by end of 2024, indicating continued expansion despite fragmentation concerns.

Market concentration remains stark despite proliferation: the top 3 players control approximately 40% of global spend. Amazon dominates with 75% US market share and roughly 42% globally, generating $56.2 billion in advertising revenue in 2024 (projected $58.5 billion). Walmart Connect holds the #2 position with $3-4 billion in US advertising revenue, showing 28% year-over-year growth in Q3 2024 and projected 31.6% growth for full year 2024. Amazon and Walmart combined are projected to capture 84.2% of US retail media ad spend by 2025. Target Roundel ranks third with double-digit growth, named by 51% of US marketers in recent surveys. Other significant players include Instacart (4th largest), Kroger Precision Marketing, eBay Advertising, CVS Media Exchange, Albertsons Media Collective, and Home Depot Orange Apron Media.

The global market reached $140-150 billion in 2024 with 21.8% growth rate—outpacing nearly all other advertising channels. The US market specifically hit $54.9 billion in 2024, projected to reach $60+ billion in 2025 (20.2% growth) and $129.93 billion by 2028 (more than doubling in four years) with 17.2% CAGR. Europe shows even faster growth at €14.3 billion in 2024 (35.9% growth), projected to reach €31 billion by 2028 (nearly doubling in three years). By 2028, retail media is projected to represent 25.7% of total digital ad spending globally, up from 18.9% in 2023—approaching parity with social media and search.

Recent launches illustrate the expansion beyond traditional retail into non-traditional categories. Major 2024 launches include Saks Media Network (April 2024, first luxury RMN), Chase Media Solutions (April 2024, first major bank-led media platform), UNFI Media Network (May 2024, reaching 30,000+ retail locations), Gopuff AI-led RMN (July 2024), and Costco’s first targeted RMN campaigns (Q1 2025 showing 2-3x expected ROAS). Non-traditional entrants now include financial services (Chase Bank), travel (United Airlines, Alaska Airlines), real estate (Re/Max), fitness (Planet Fitness), payments (PayPal), and food delivery (Uber). The terminology is evolving from “retail media” to “commerce media” to encompass non-retail platforms, with financial media networks projected to reach $35 million in US in 2024, quadrupling by 2026.

Fragmentation has become the industry’s defining challenge in 2024-2025. 70% of buyers cite lack of standards as a barrier to investment (IAB Europe), and 69.7% identified “complexity in the buying process” as the biggest obstacle to RMN growth (IAB study of 200+ advertisers spending $5M+ annually). Each network operates with its own metrics, identifiers, and dashboards; no standardized attribution methodologies exist across platforms. Industry expert consensus declares “fragmentation is the biggest challenge of 2024” across multiple sources including CitrusAd, Skai, and Publicis Commerce. Brands struggle to unify reporting and benchmark performance, risking budget fragmentation, and most brands don’t have headcount to manage 10 different RMNs effectively without centralized tools.

The market shows early consolidation signals: only 35% of marketers planned to add more RMN platforms in 2024, down from 58% in 2023, indicating brands are actively seeking to reduce complexity rather than continue expansion. However, the projected increase from average of 6 RMNs currently to 11 by 2026 suggests brands must still engage more networks to reach their customers across shopping destinations. 50% of advertisers partner with just 5-10 networks despite 200+ existing, creating a long tail of smaller RMNs struggling to attract advertiser attention due to operational complexity barriers.

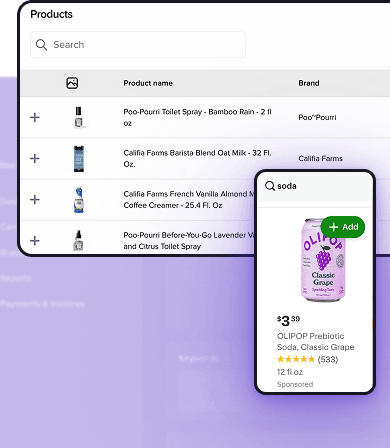

Unified platforms and automation reduce costs by 40-60%

Solutions for managing retail media complexity have matured significantly in 2024-2025, with enterprise platforms, automation capabilities, and industry standardization efforts providing viable paths forward. The leading retail media management platforms offer comprehensive multi-network control: Pacvue powers 12% of total retail media ad spend worldwide, covering 100+ retailers including Amazon, Walmart, Target, Instacart, and Tesco with AI-powered optimization, starting at $500/month with highest tier at 3% of ad spend. Skai (formerly Kenshoo) manages 100+ retailers with unified omnichannel capabilities across retail media, paid search, paid social, and app marketing using AI-driven forecasting and predictive budgeting. Perpetua offers “set-it-and-forget-it” automation across Amazon, Walmart, Instacart, and CitrusAd’s 25,000+ retailer network, with pricing from $695/month plus percentage of ad spend for growth tiers.

These platforms deliver quantified efficiency gains and performance improvements. Case studies show Instant Pot achieved 260% sales growth across Amazon, Target, and Walmart after consolidating management through Pacvue, gaining real-time visibility and control. Panasonic improved incremental ROAS by 33% using Pacvue’s incrementality console and digital shelf signal optimization. Walmart Connect’s 21-day dynamic bidding optimization test for a fashion advertiser delivered +20% ad-attributed sales, +12% orders, and +5% conversion. Brands using AI-driven retail media platforms report 60% increase in ad sales, 40% lift in incremental ROAS, 50% reduction in reporting time, and 4x uplift with AI personalization versus traditional keyword targeting.

The time savings from automation are substantial and well-documented. Automated data connectors save 15-20 hours per week on reporting consolidation. Operations teams reduce manual data consolidation from 20-40% of their time to near-zero with unified dashboards. Dynamic bidding eliminates daily manual bid updates, saving 15-25 hours weekly. Campaign setup time reduces from days to under an hour with templated automation. Automated inventory syncing updates across platforms in 2 hours versus manual processes taking 48+ hours. Budget reallocation can happen mid-flight in real-time versus requiring multi-day coordination meetings and platform-by-platform implementation. The cumulative impact: platforms enable managing 100+ retail networks from single interfaces with staffing efficiency improvements of 40-60%.

Industry standardization efforts are progressing despite retailer resistance. The IAB/MRC Retail Media Measurement Guidelines finalized in January 2024 after 18-month development cover data quality, audience measurement, ad delivery, viewability, attribution, and incrementality. The framework requires transparent disclosure of attribution window type and length, statistical models used, whether online-only or omnichannel, extrapolation methodologies, and control group methodology. IAB Europe finalized standards in April 2024 after public comment, with 70% of buyers citing their absence as investment barriers. The IAB In-Store Retail Media Standards were finalized in December 2024 after public comment, providing first-ever industry definitions for in-store digital retail media with 14 RMNs participating.

Early adoption shows promise: CVS Media Exchange became the first health/wellness RMN to adopt IAB standards, Kroger Precision Marketing contributed to standards development, and Target Roundel implemented measurement aligned with standards. However, Amazon—representing 75% of US retail media spend—has not formally adopted standards, continuing to use proprietary measurement. The ISBA Responsible Retail Media Framework, developed with Omnicom Media Group and 25+ brands/retailers, provides additional standards for definitions, data availability, attribution, and transparency. The IAB Europe Retail Media Certification Programme launched in May 2024 as the first transparency initiative with standardized measurement protocols and independent auditing.

Best practices from leading brands emphasize strategic frameworks over tactical execution. 85% of brands now use retail media for upper-funnel awareness, not just bottom-funnel conversion, with 39% planning to spend more on offsite retail media in 2024. Multi-channel strategies significantly outperform single-channel approaches: Nielsen found well-balanced campaigns achieve 90% on-target reach versus 17% for single-channel efforts—a 5X improvement. Recommended budget allocation starts with core platforms (Amazon, Walmart, Target), tests emerging platforms with 10-20% of budget, uses unified analytics to compare performance, and reallocates based on incremental ROAS rather than last-touch attribution.

The in-house versus agency decision has shifted: 82% of ANA members now have in-house agency capabilities (up from 58% in 2013), with 70% maintaining strategic capabilities including brand strategy, creative, and media. However, big six holding companies still control ~30% of US ad spending, and 47% of marketers say agencies remain solely responsible for media buying and planning. The hybrid model prevails: keep strategic planning, day-to-day management once established, first-party data management, and budget allocation decisions in-house, while using agencies for initial RMN setup, specialized expertise (DSP management, Amazon Marketing Cloud analysis), creative production at scale, and new platform testing. Agencies offer 10-30% cheaper technology rates through volume agreements, specialized talent (data scientists, programmatic experts), cross-client insights, and reduced time-to-market (versus 90-day average for in-house hiring).

Stop the bleeding before scaling further

The retail media opportunity remains immense—$140 billion market growing 21.8% annually with closed-loop attribution and high-intent audiences at point of purchase. But for brands managing campaigns across 6-11 retail media networks, the hidden costs of fragmentation are currently consuming 20-50% of potential returns through operational inefficiency, measurement inconsistencies, delayed optimizations, and suboptimal budget allocation. The quantified costs tell a clear story: $28 billion in industry-wide revenue loss from fragmentation, $10 billion in optimization opportunities from inefficient spend with incremental ROI below 1x, 15-20 hours weekly per brand wasted on manual reporting consolidation, and 33% performance improvement left on the table by brands lacking sophisticated frameworks.

Immediate actions for brands: First, audit your current state by documenting all RMN spend, platforms, and metrics to establish baseline efficiency. Second, implement a unified management platform—Pacvue, Skai, RMIQ, or similar—enabling centralized control that reduces operational time 40-60% while improving performance. Third, standardize metrics by creating common KPI definitions that enable true cross-platform comparison rather than relying on each network’s self-reported ROAS. Fourth, automate basics including bid management, budget pacing, and reporting to free strategic capacity currently consumed by tactical execution. Fifth, demand incrementality testing using control groups or geo-holdout methodology to measure true lift rather than attribution artifacts, allocating 5-10% of budget to quarterly testing.

Strategic priorities must shift from channel expansion to channel optimization. The data shows brands are already consolidating: only 35% planned to add new RMN platforms in 2024, down from 58% in 2023. Follow Bain’s recommendation to focus on 6 or fewer strategic RMN partners for direct management, using technology solutions to manage the long tail of retail media networks. Prioritize RMNs where your customers actually shop, not where retailers offer the most aggressive co-op terms. Break down silos between e-commerce, shopper, brand, and media teams to enable unified decision-making and budget flexibility. Invest in incrementality measurement as the primary KPI—71% of advertisers now recognize it as most important, yet most still optimize based on last-touch ROAS that over-credits bottom-funnel tactics and ignores 40-50% of campaign value from organic lift, halo effects, and repeat purchases.

For brands spending $2M+ annually on retail media, the business case for unified platforms is overwhelming. A typical 3-person team costs $302,000-$485,000 annually before technology costs. Consolidating through Pacvue ($500/month to 3% of spend) or Skai (custom enterprise pricing) while reducing staffing needs by 40% creates immediate ROI even before performance improvements. Add documented ROAS improvements of 50-200% from case studies, and the payback period shrinks to weeks or months. The alternative—continuing to manage platforms individually—becomes indefensible as complexity doubles from 6 to 11 networks by 2026.

The retail media channel will continue growing 20%+ annually regardless of these challenges, but the winners will be brands that solve operational complexity now rather than waiting for industry-wide standardization. Early adopters of unified management solutions are already capturing competitive advantages: real-time visibility enabling within-day optimizations, cross-network insights revealing budget reallocation opportunities worth 22% more incremental sales, and freed capacity allowing strategic focus on incrementality and full-funnel integration rather than tactical firefighting. The $28 billion fragmentation problem is solvable—but only for brands willing to prioritize efficiency over expansion in the next 12-18 months.